/ Financial behaviour of Gen-Z/ Discover

Research Tools and Activities

Unlike traditional research methods, we employed a discussion guide that involves in-depth qualitative interviews supplemented by interactive activities to explore Gen Z’s financial behaviours, decision-making processes, and trust in financial systems. The approach combines behavioural probes, scenario-based exercises, and hands-on financial simulations to extract insights beyond stated preferences.

The study utilizes a mix of visual, interactive, and narrative-based exercises designed to uncover motivations, preferences, and barriers in financial decision-making. These include:

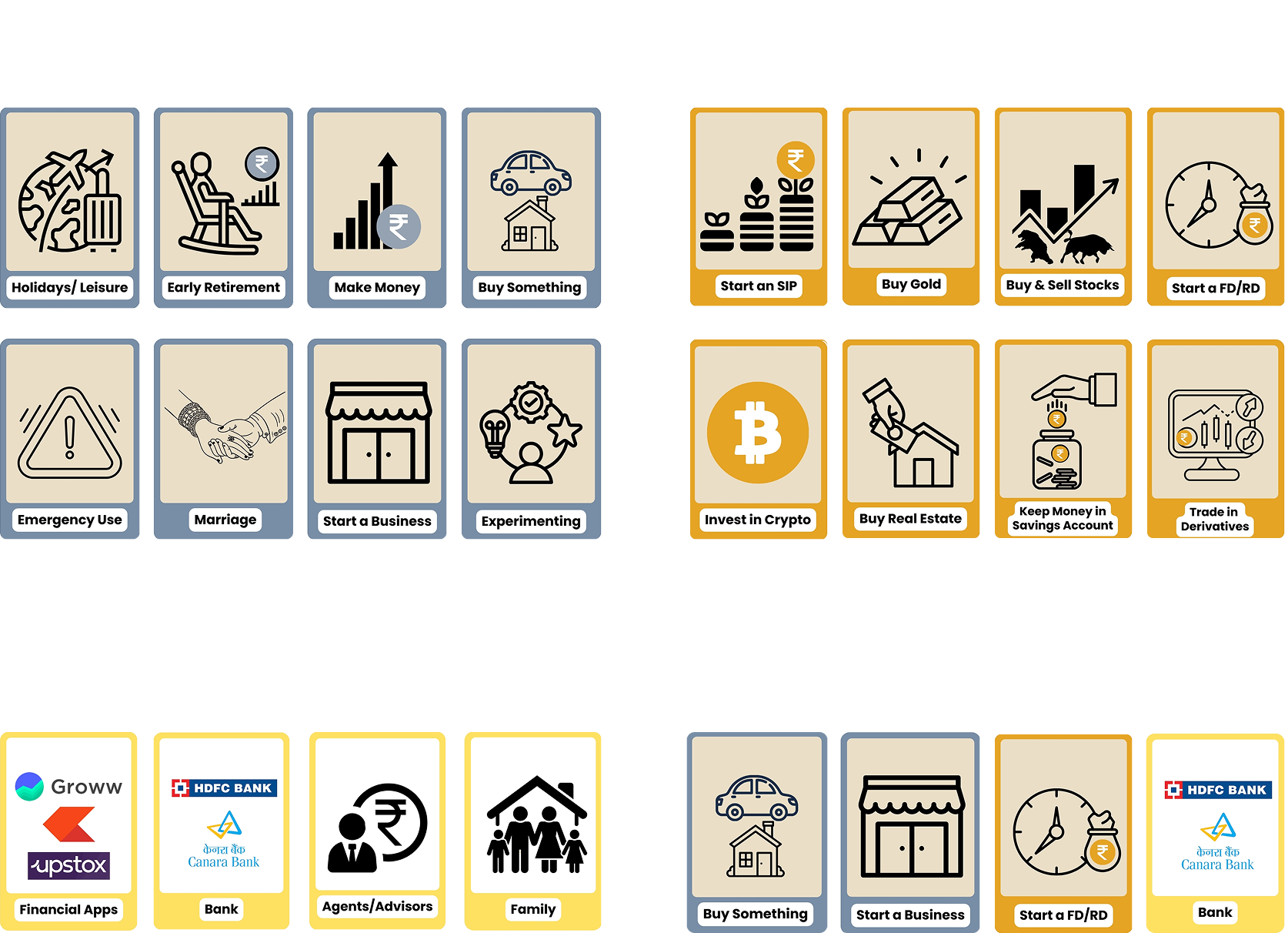

Cash Flow Chronicles

Participants allocate funds across spending and savings/investment categories to reflect real-life financial priorities. It helps to understand their preferences and rationale while allocating money and reveals their thought process behind prioritising certain expenditures.

The Investment Odyssey

Back-casting techniques to understand how individuals set and work toward financial goals including the preferred sources of information, tools, and platforms that the participants use to make informed decisions.

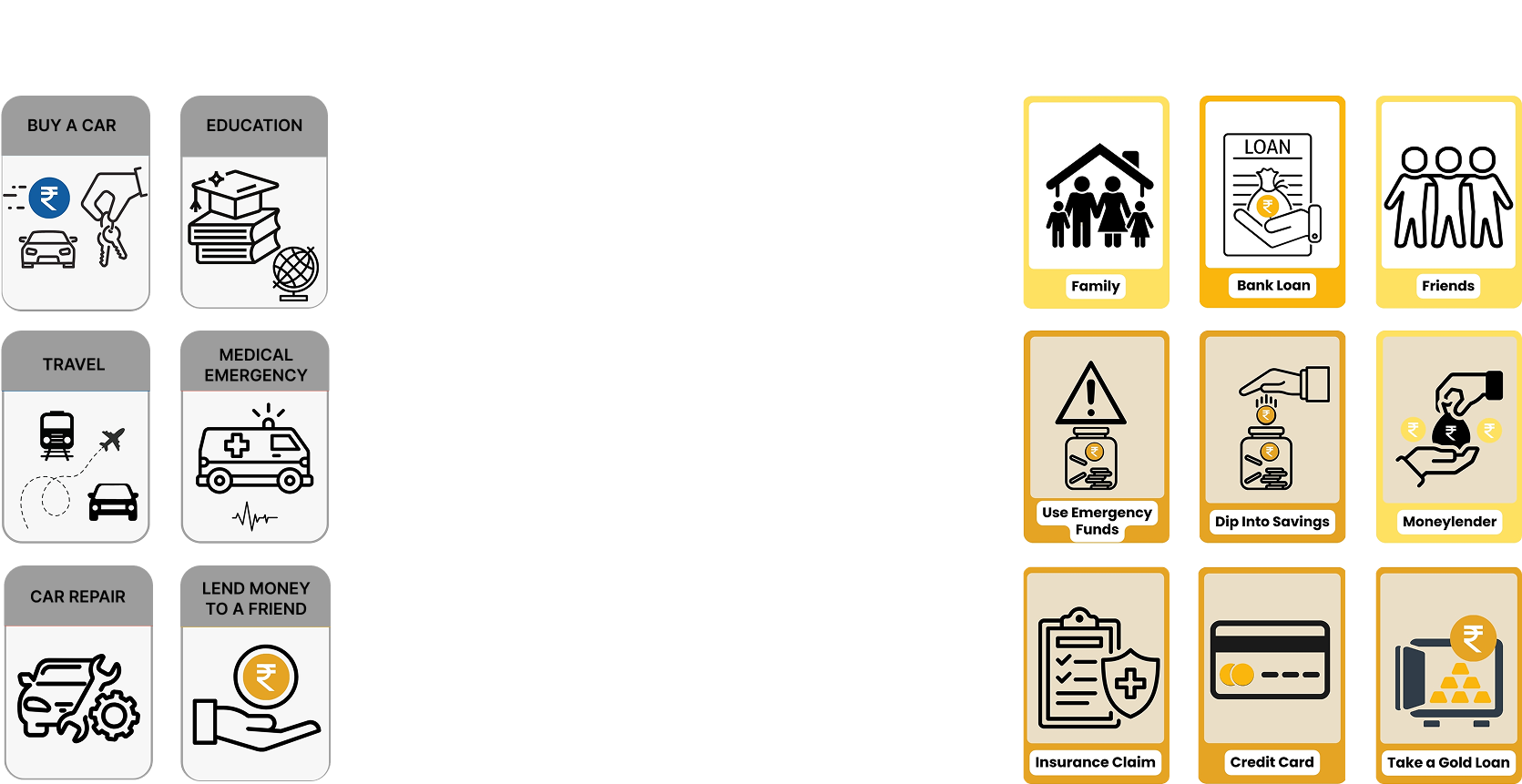

Lend it or Spend it

Using various situation cards, we explore trust levels, trade-offs, and considerations when choosing between formal and informal credit sources including the factors influencing trust and accessibility of these credit sources. This will help in identifying gaps and opportunities in credit accessibility for targeted interventions.

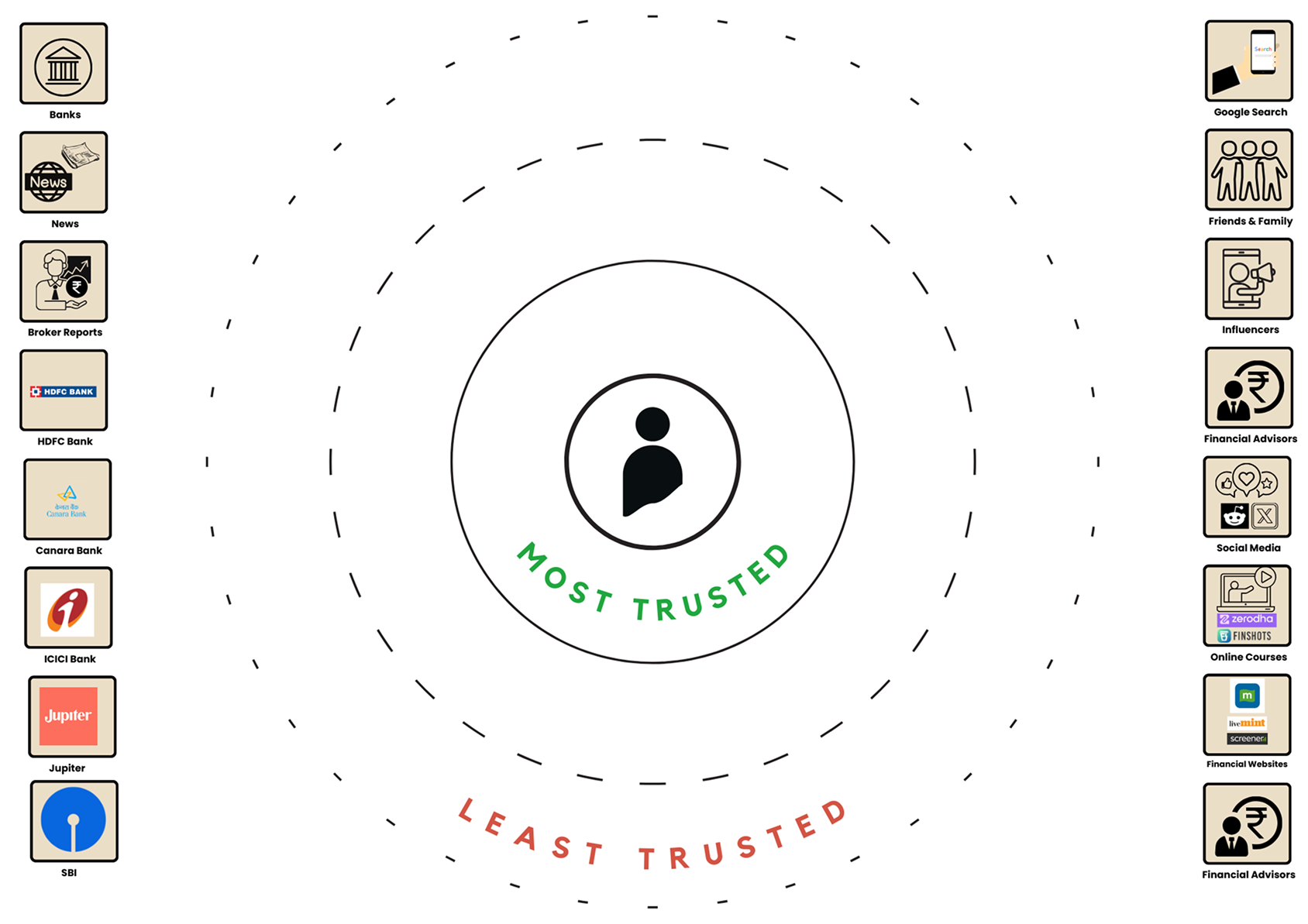

Ecosystem Trust Mapping

Enables participants visually represent their trust levels across three dimensions: information, advice, and transactions. Participants use a set of pre-defined source cards to place within concentric circles representing their level of trust.

The innermost circle represents the most trusted sources, while the outermost circle represents the least trusted. It helps in exploring how participants assign trust across different sources for financial information, advice, and making transactions, and to uncover gaps or opportunities for building trust in financial ecosystems.

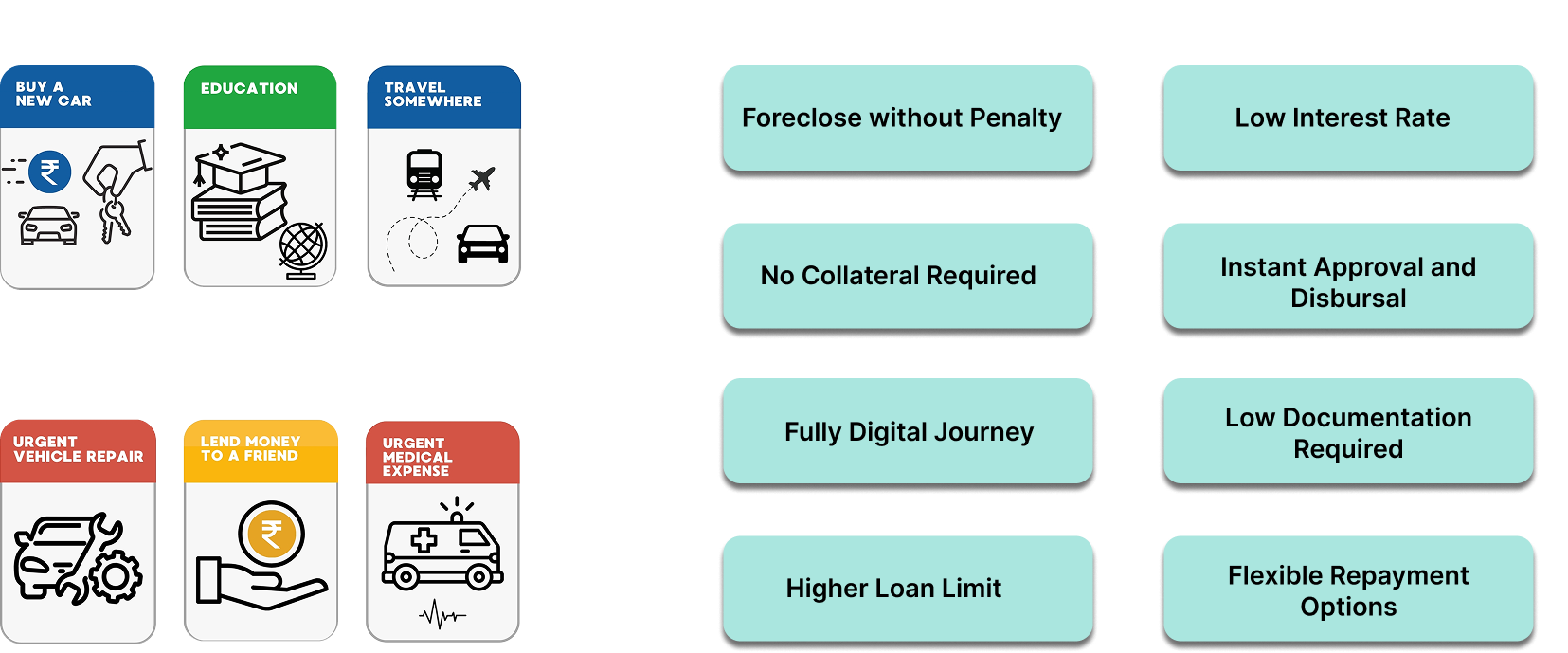

Loanopoly

Participants are presented with two groups of expenses—Planned (education, buying a car, study abroad) and Unplanned (medical emergency, vehicle repair, lending money to a friend).

Each participant selects three expense cards from these options and matches them with loan feature cards— for example- low interest rate, foreclose without penalty, no collateral required, and higher loan limit—to indicate their preferences.

Through this process, participants share their reasoning and reflect on the factors influencing their choices, exploring how loan features align with their needs and the trade-offs they are willing to make in different scenarios.

These tools bridge the gap between intention and action, revealing implicit biases, misconceptions, and gaps in financial awareness.